Level Money

Helping Capital One customers spend and save with confidence

Introduction

I joined Level Money just after they were acquired by Capital One in July of 2015. The focus was on a major design refresh that would make the main feature, Spendable, more accessible in the overall app architecture.

“Spendable” is designed to show what is left to spend once bills have been paid and savings has been set aside. There was an opportunity to incorporate a savings feature to support Spendable giving our customers a balanced approach at stress free budgeting.

Lead UX Design

My Role

As the lead UX designer I was responsible for the experience strategy and design deliverables for the iOS and Android apps. I defined and led research to better understand the mental model of individual financial savings behaviors to inform the creation of a customer journey map and target persona. These insights would influences each stage of design up to the initial launch in 2016.

Level Saving

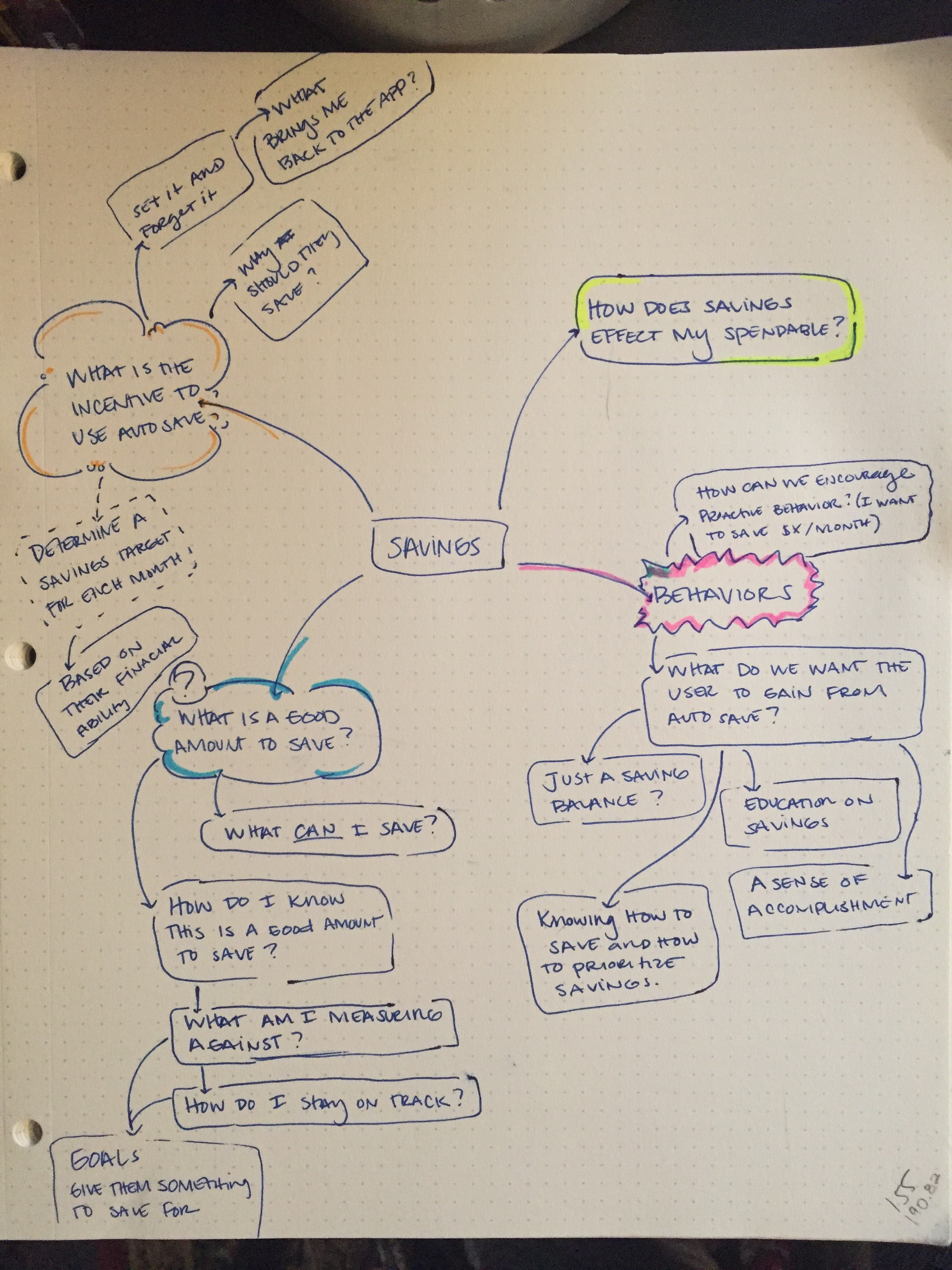

While Spendable determines how much money can be spent in a month, Level Saving helps answer the question “how much can I save?”. Level Money has a direct link to bank and credit card accounts and can see how money is being spent, it can also determine how much should be put into a savings account without harming a budget.

Level Savings’ design focuses on building medium to long term savings habits by balancing spending activity with savings potential. Unlike traditional savings plans that transfer one large sum of money into a savings account, Level Saving transfers small amounts over the course of a month. It’s designed to detect if a customer's spending or bills have increased and automatically adjust the savings transfer amount or discontinue transfers until the account has become more stable.

Automation vs. manual savings

During early concept testing, we explored multiple types of automated savings. People really liked the idea of “hidden money” but I kept hearing the concern about lack of control and not knowing how much is going to be saved. The need to be able to contribute to their savings was greater than their desire to sit back and let the machines do it for them.

Early concept wireframes used in validation testing. (Rollover Savings, Savings Goals, and Automated Savings)

Setting the requirements

Early empathy studies revealed that customers prefer automation when it comes to their money. Things like auto pay, direct deposit, and alerts are pretty common, so It was assumed that customers would want the same level of automation when saving. This proved to be only partially true.

Through rapid iterative testing I learned that people enjoy seeing their savings increase because of an action they took. During an interview one participant said they “felt proud when they were able to move money into their savings account” and congratulated themselves in the memo to remind them of this “little win”. Also, there was an overwhelming need to see savings progress in the form of more than just a balance update.

Once the designs began to mature my product partners and I looped in the engineering teams to begin defining the technical requirements. We were operating under the assumption that the money saved would be moved into a savings account already connected to the Level Money app regardless of the bank institution. This created too much risk for Capital One, which required that the feature only move money into a Capital One savings account.

To accommodate the shift in requirements, I designed an application for Level Money customers to open a Capital One 360 Savings account while setting up the savings feature.

Balancing saving and spending

The pilot version of Level Saving includes a savings goal that is designed to work in partnership with Spendable. The customer chooses their goal and if their spending activity can support it, money is moved into a Capital One savings account. Customers without a savings account can open one while setting up the feature.

Onboarding Account Opening (Happy Path)

To support the needs for user control and awareness, the designs included opportunities for the customer to easily view their progress for the month with a visual graph that shows how close they are to their goal. Customers can start and stop the automated deposits when they need to, and can transfer money back into their checking account at any time.

Early learnings

Early findings from our pilot studies have revealed some findability issues with the saving feature. Currently, the placement of Level Saving in the app is not equally weighted to the Spendable feature and their correlation is not intuitive. Since these two values are partners in the customer's financial budget, there is a need to restructure the app architecture to increase findability and highlight their interdependence.

During validation testing the interactions of 6 participants were captured and plotted on a journey map to quickly gather positive and negative moments. This allowed for faster iteration in obvious problem areas.

Takeaways

When I joined Level Money at Capital One, I had never worked in the financial sector. I gained a great respect for empathy studies and user research interviews to help determine what set of features would make Level Saving work for the target audience.

During this project I was fortunate to work with a team of user centric researchers, engineers, and product partners that provided amazing insights and contributions to the final product. They were my partners through the whole process. I am grateful for this experience, as it has taught me a great deal about leading a project of this size and how strong collaboration with all stakeholders makes releases easier to get to.